Are Federal Taxes Unconstitutional? Was the 16th Amendment Tax Ratified?

If you think you aren’t required to pay taxes because the 16th Amendment to the Constitution wasn’t ratified and you fail to pay your taxes to the IRS, you could find yourself in hot water.

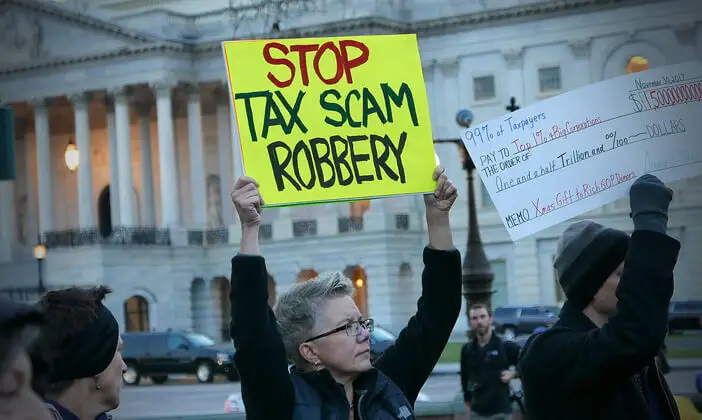

A clever scam, perhaps more hoax than scam, used by those who want to convince you that federal taxes are unconstitutional. Their argument is that federal taxes are unconstitutional because not all fifty states ratified the 16th Amendment to our constitution. What they fail to mention is that not all fifty states are required to ratify an Amendment in order to implement it as U.S. law.

False belief turned cottage industry

There are people who make a living teaching others about how they can use the argument that the 16th Amendment wasn’t ratified to justify not paying federal income tax. They advertise and conduct seminars all across America and people are falling for it. But they don’t tell you the entire story. This hoax has been going on for years. And there are plenty of court rulings throughout American courts that confirm the 16th Amendment was in fact ratified. It only takes three quarters of our fifty states to ratify an amendment to the U.S. Constitution. Most people don’t know that fact.

It’s not an investment. It’s tax evasion!

Our advice is not to fall victim to someone who wants to tell you information you’re only too happy to hear. Their motive isn’t altruistic, they want to sell you a book or assess a fee to attend an “exclusive” workshop or sell you a packet with all the materials you’ll need to become a protester of federal taxes. If you follow their advice, what you’ll ultimately end up being is a convicted federal income tax evader. More money will be spent in penalties that you would have spent just paying your taxes up front. And there’s always the possibility of jail time. Do you really think these con artists follow their own advice?

The Top Excuses not to File Taxes

The IRS has an entire section on their website dedicated to “The Truth About Frivolous Tax Arguments“. We encourage all those considering not paying their federal income taxes to visit their site. “The Truth About Frivolous Tax Arguments” includes information on frivolous tax arguments in general, frivolous tax arguments in collection due process cases and penalties for pursuing frivolous tax arguments.

So, even though most of us would jump at the chance to not pay federal income taxes, using any of the arguments above won’t make that a reality. In spite of this, people continue to fall for the promises made by those claiming that paying federal income tax is avoidable if you simply follow their sage advice.

The IRS understands there are people out there trying to make a buck off of gullible taxpayers and have started going after these sham promoters. They’ve provided a form on their website for reporting abusive tax promotions and/or promoters.

Significant Tax Protesting Court Cases

- Miller v. United States, 868 F.2d 236, 241 (7 th Cir. 1989) (per curiam)

- United States v. Stahl, 792 F.2d 1438, 1441 (9 th Cir. 1986), cert. denied, 479 U.S. 1036 (1987)

- Knoblauch v. Commissioner, 749 F.2d 200, 201 (5 th Cir. 1984), cert. denied, 474 U.S. 830 (1986)

- United States v. Foster, 789 F.2d 457 (7 th Cir.), cert. denied, 479 U.S. 883 (1986)