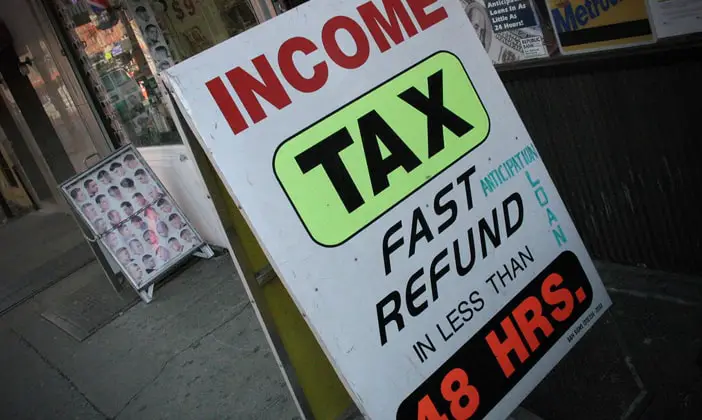

Income Tax Refund Loan Scams

Beware tax preparers promising tax return funds immediately. They’re taking advantage of people’s desire to receive what’s due to them faster than what the federal government will return. By employing a “refund anticipation loan” program, professional tax preparation companies have created a system that allows tax payers the ability to leave their offices with money in hand.

Notice that we said “refund anticipation loan”, heavy emphasis on the word “loan”. And because of that one word, we recommend avoiding these deceptive practices. While it’s accurate to say that you won’t lose your money to these companies as one would in a traditional scam, you will end up paying more for the refund you would have received at a later date from the federal government. There are ways to get your refund quicker than using these services. We recommend filing your taxes electronically and taking advantage of the IRS’s service to credit your refund using direct deposit into your checking or savings account.

The Cost of the Loans is too high

There’s risk involved in these “refund anticipation loans”. The tax preparer offering this service will not only charge for their regular fee, but they will also charge an additional fee for generating the loan. These loans are based upon what they “predict” you’ll receive back from the IRS based on the deductions they found for you. As I said before, this is a loan so you will need to make sure you pay it back in full. So if the IRS disallows some of your deductions and your refund ends up being smaller than you expected you will still need to pay back everything you borrowed.

If you had just waited for the electronic transfer or the mailman to bring you your refund, instead of falling prey to your own impatience, not only would have a larger check, you would also have a lot less hassle in the end.

Do the Math!

We know we’re beating the repetitive drum, but if you take a minute to do the math you’ll see that it’s just not worth it to take these companies up on their offer. Being patient and waiting for your check or electronic transfer can save you more in the long run. You’ve waited all year for this. A few weeks more shouldn’t hurt.